open ended investment company taxation

The tax base for the calculation of income tax is the total amount of the funds net assets less allowable deductions. By Anthony Stewart Laura Underhill and Violet Marcel Clifford Chance LLP tax group and Simon Crown Clifford Chance LLP regulatory group.

Difference Between Open Ended And Closed Ended Mutual Funds

OEICs are a form of authorised investment fund IFM02110 and are subject to the tax.

. The Open-ended Investment Companies Tax Regulations 1997. This practice note discusses the tax treatment of authorised unit trusts and open-ended investment companies OEICs. No deductions from the sum distributed to shareholders as dividends are permitted while determining the tax base.

Must maintain cash reserves restricting returns. Company Bakeries for an order under Section 6 c retroactively exempting from the provisions of Section 17 a 2 of the Act the purchase by Bakeries of shares of its common stock from Mathers Fund Inc an open-end investment company registered under the Act. Capital gains are exempt from tax at fund level and instead CGT is levied at client level on disposals.

The operation of subchapter M is widely known and relatively simple. Require mid-to-long-term investment horizon. Stamp duty does not apply to shares in non-UK investment companies or to shares quoted on AIM.

The income tax rate for investment funds is 001 on its tax base. Unit trusts and open-ended investment companies. An OEIC is an investment company subject to corporation tax on its taxable income at the funds rate of tax which is equal to the basic rate of income tax currently 20.

In broad terms this means thatthe gains of an OEIC are not subject to Corporation Tax and shares in an OEIC like unitsin a unit trust are treated in the same way as other shares. It also considers the tax treatment of investors in these authorised investment funds including on. Tax within the fund.

The company pools money it raises by selling shares in a fund and the funds manager invests in stock bonds money market instruments or a combination of these asset classes to meet the funds specific objectives. The tax rules aim to put the investor in broadly the same position as if they had invested in the funds assets directly rather than through the fund. By Anthony Stewart and Laura Underhill Clifford Chance LLP tax group.

OEICsUTs are only subject to tax within the fund on income received by the fund manager. Open-end investments such as mutual funds do not pay taxes on their own but also pass on the tax burden to their investors. The OEIC is both legal and beneficial owner of its assets.

An open-end investment company issues and redeems or buys back shares in the mutual funds it sponsors on a continuous basis in response to investor demand. IC-9384 - July 30 FOUNDATIONSTOCKFUND. A fund manager pools money from many investors and buys shares bonds property or cash assets and other investments.

They form part of many client investment portfolios and advisers need a thorough understanding of how they are taxed both on distributions and on disposals. OEICs Open Ended Investment Companies and unit trusts are commonly used collective investments and share the same tax treatment. Unit trusts and Open-Ended Investment Companies OEICs are professionally managed collective investment funds.

So if you buy newly issued shares for example in a VCT there is no stamp. This practice note provides an overview of the tax issues that arise in respect of UK authorised and unauthorised unit trusts and UK open-ended investment. Investment companies that distribute all or sub-stantially all of their income to shareholders are exempted from taxation on.

12 the 1992 Act of open-ended investment companies within the meaning of the Financial Services Act 1986 c. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c. OEIC are not tax-advantaged.

And capital gains - all set out in an easy to read table. The income tax and capital gains tax consequences of each with reference to. Typical examples of such an investment would be a cash or corporate bond unit trust.

It is charged only when shares are bought on the secondary market. So interest and dividends are taxable and selling shares may incur a. The authorised unit trust is referred to as the target trust and the open-ended investment company as the acquiring company.

This module should take around 30 minutes to complete. Stamp duty reserve tax to give it its full name is charged at 05 on the purchase but not sale of investment company shares. This means investors pay taxes on any capital gains or income derived.

A summary of the three types of units in a unit trust or shares in an OEIC. Interest and rental income are subject to corporation tax at 20. With a Unit trust the fund is split into units and this is what you buy.

An AIF is an authorised unit trust or open-ended investment company OEIC and interest distributions would usually be paid out of the income of an investment fund which is invested broadly as to more than 60 in interest-bearing investments. A land transaction where a property that is subject to the trusts of an authorised unit trust is transferred to an open-ended investment company may be relieved from tax if the necessary conditions are met. 60 which are incorporated in the United Kingdom.

Sections 851-55 certain investment companies may obtain a virtual exemp-tion from federal income taxation. Authorised unit trusts and open-ended investment companies.

Difference Between Open Ended And Closed Ended Mutual Funds

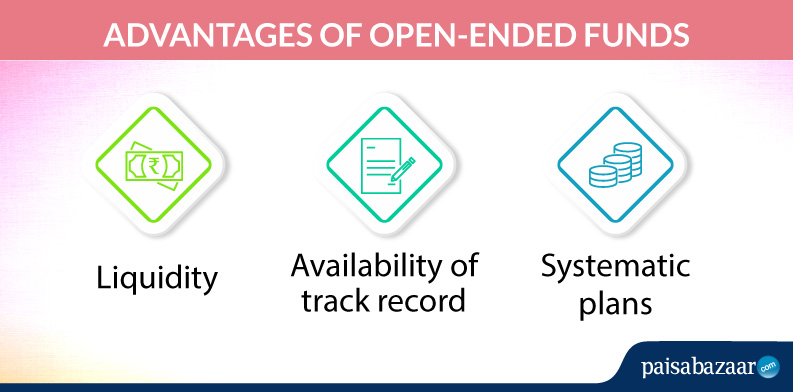

What Are Open Ended Funds Meaning Difference Advantage Disadvantage

Doing Business In The United States Federal Tax Issues Pwc

Types Of Mutual Funds Investing Mutuals Funds Safe Investments

Interval Funds Features And Benefits Taxation 5 Top Interval Funds

How Brokerage Accounts Are Taxed In 2022 A Guide

What Are Open Ended Mutual Funds Who Should Invest In It

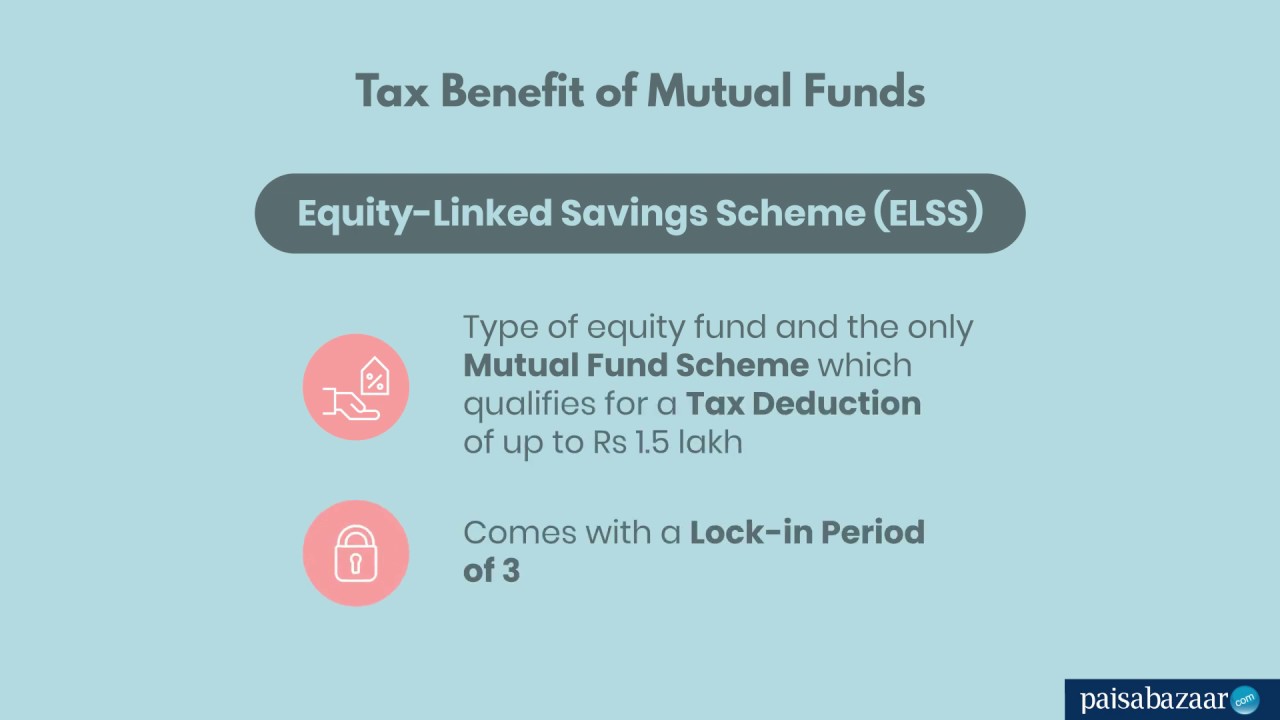

Tax On Mutual Funds Taxation Rules How Are Mutual Funds Taxed

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Understanding Leverage In Closed End Funds Nuveen

What Are The Differences Between Open End And Closed End Real Estate Funds Origin Investments

What Are Open Ended Mutual Funds Who Should Invest In It

Closed Ended Funds Overview Advantages And Taxation

Tax Efficient Investing In Gold

Invest In Mirae Asset Focused Fund For Wealth Creation Mirae Asset Investing Equity Mutual Funds Investing

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)